35+ should i buy down my mortgage rate

Web Temporary mortgage rate buydowns are a little more complicated but can help borrowers afford a home by reducing interest rates dramatically for up to three. Web The number of points you pay should come down to how much cash you have on hand to cover the higher closing costs versus how much you want to lower.

Year 1 Of A 500k Mortgage At 5 Interest Under 30 Of Your Mortgage Payment Pays Down Principal Builds Equity R Canadahousing

Ad Compare Loans Calculate Payments - All Online.

. Web Simply put a mortgage rate buy-down is upfront money often paid by the home seller builders and lenders can also front the cost to buy down the interest. As you can see the monthly payment with three points is 35 less per month than the zero-point option. Proudly Offering a Broad Selection of Programs to Make Homeownership Affordable.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. But if you want a rate of. Web And the rate of 6375 actually results in a lender credit which is the opposite of a buy down because you get money back to cover closing costs.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Check How Much Home Loan You Can Afford. Web You can do a buydown by purchasing mortgage points sometimes called discount points on your loan at closing.

Web On a 300000 loan with a 7 interest rate purchasing one point brings the mortgage rate to 6755 dropping the monthly payment from 1996 to 1946 a monthly savings of. Loan amount - If youre getting a mortgage to buy a new home you can find this number by subtracting. Web At least 20 percent down typically lets you avoid mortgage insurance.

Ad Search for the Home You Want with a Mortgage That Fits Your Budget. Ad Compare Loans Calculate Payments - All Online. Web Your mortgage lender Your loan type Your loan term Your loan amount The number of points you purchase For example say you borrow 200000 at a fixed.

Web If you paid 5000 to drop your rate from 475 to 425 you would need to make regular monthly payments for at least 68 months to save more money than you. However you pay 3000. Web If you dont lock in your interest rate rising interest rates could force you to make a higher down payment or pay points on your closing agreement.

Weighing the monthly savings against the. The cost depends on your credit score the type of loan and what the market is doing. Web One percent of 100000 is 1000.

Regulators also announced similar. Web If the down payment is less than 20 mortgage insurance may be required which could increase the monthly payment and the APR. Web Generally 1 point will buy your rate down 18 0125 to 14 025.

Ad Top Home Loans. A mortgage point typically costs around 1 of. Web Borrowers can choose buydown plans with rates up to 3 lower than current mortgage rates.

Web The bank entered receivership on Friday after trading of its parent company SVB Financial Group SIVB -6041 was halted. Check How Much Home Loan You Can Afford. For example if market rates are 5 a 2-1 buydown would allow you to.

Web Buying down the interest rate on your mortgage can save you tens of thousands of dollars over the life of the loan.

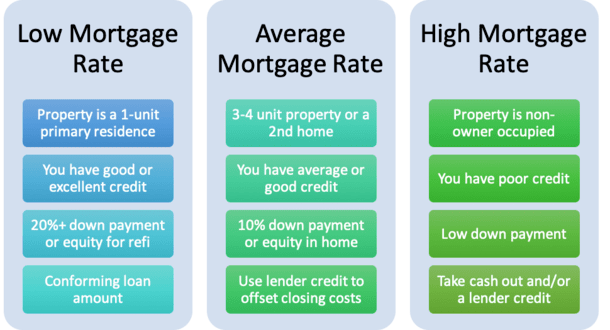

What Mortgage Rate Can I Expect Answer These Questions First

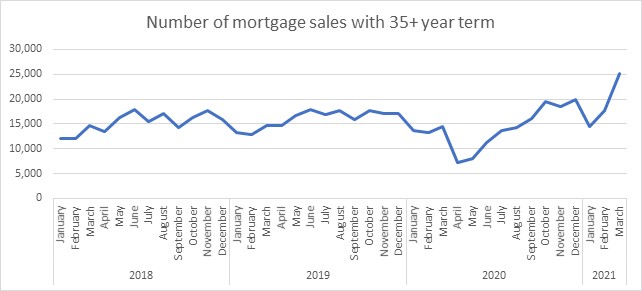

New Data Shows Stark Increase In Mortgage Sales With 35 Year Terms Quilter Media Centre

Is Buying A Lower Mortgage Interest Rate Right For You Quicken Loans

Buying Down Mortgage Rates With Discount Points

Should I Pay For A Lower Interest Rate On My Mortgage

The Dark Side Greater Fool Authored By Garth Turner The Troubled Future Of Real Estate

What Type Of Hdb Flats Can Single Singaporeans Buy

Buying Down Your Interest Rate Determine If It S Worth The Cost

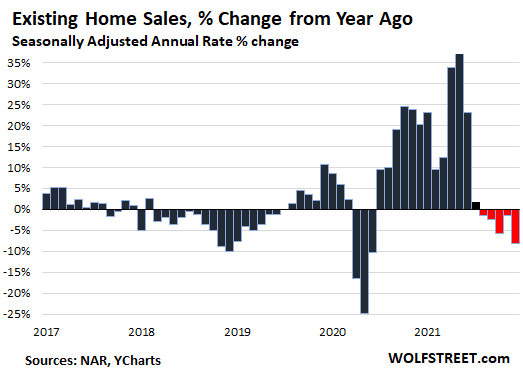

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

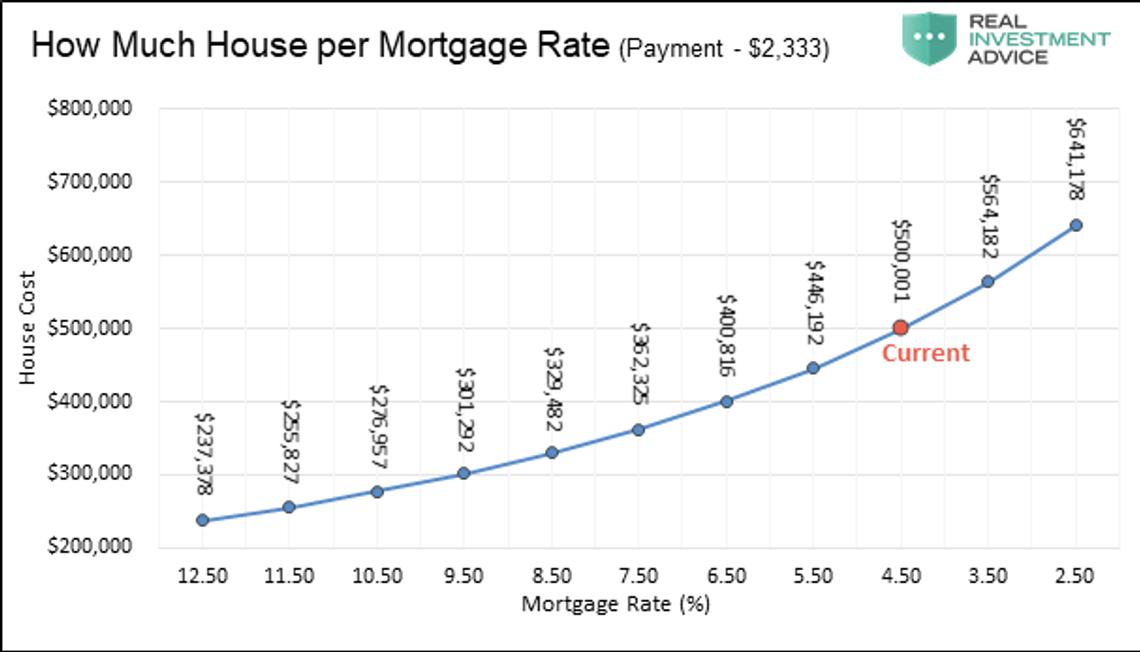

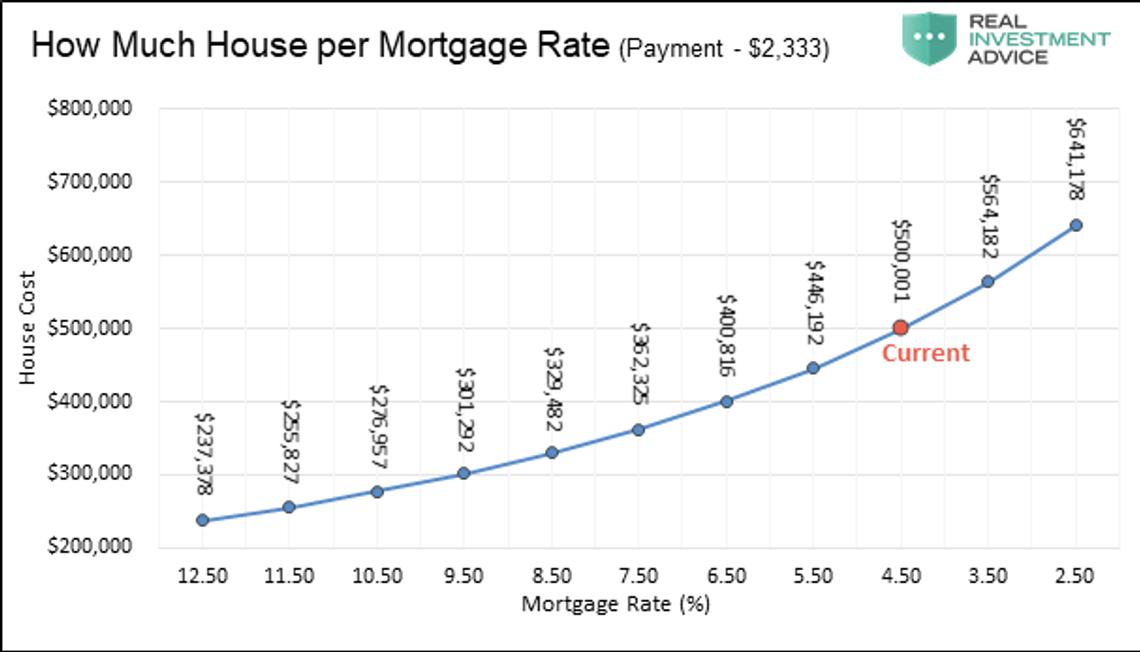

Interest Rates And Your Mortgage Maplewood South Orange Real Estate And Homes

How Mortgage Points Work And When To Pay For Them Smartasset

Buy Down Interest Rate Is It Worth It Supermoney

The Week On Wall Street A Market Full Of Unanswered Questions Seeking Alpha

The Difference In Retirement Savings If You Start At 25 Vs 35

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

First Home Buyer Bfg

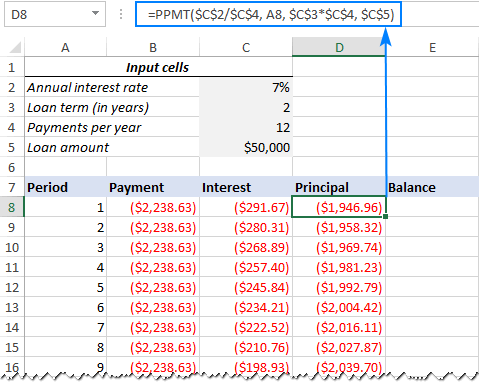

Create A Loan Amortization Schedule In Excel With Extra Payments